amazon flex taxes canada

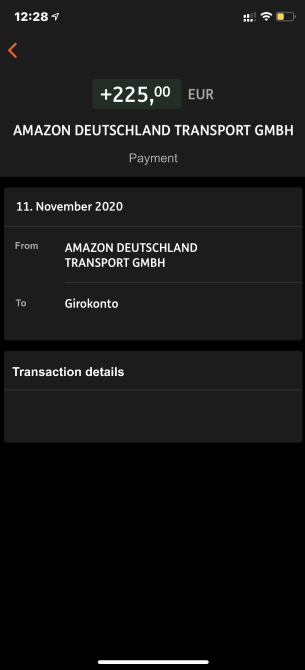

Amazon will not withhold taxes on the earnings of Canadian tax residents. You expect your withholding and credits to be less than the smaller of.

Amazon Flex Support How To Easily Contact Amazon Customer Service

28 Amazon Flex reviews.

. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. Driving for Amazon flex can be a good way to earn supplemental income. Turn on Location Settings.

90 of the tax to be shown on. Amazon flex business code. New Brunswick 15 Newfoundland 15 Nova Scotia 15 Prince Edward Island 15 When you make a sale on Amazonca you may be required to register collect and remit GSTHST andor PSTRSTQST even if you do not have a physical presence in Canada or a particular province.

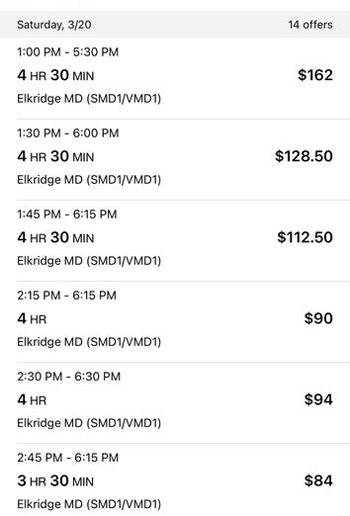

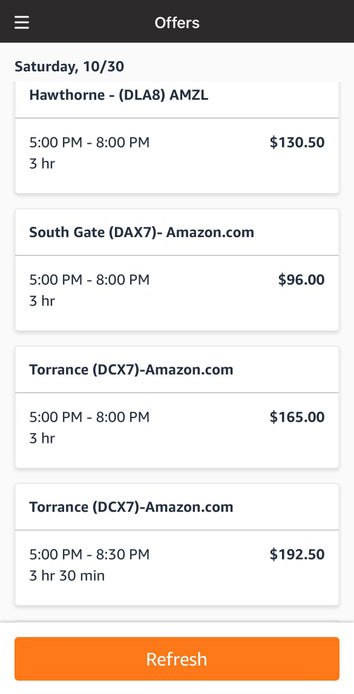

Most drivers earn 18-25 an hour. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year.

Make sure that you have all the necessary information for enrolment. Go to the Tax Exemption Wizard. Make CAD 22-27hour delivering packages with Amazon.

New Amazon Flex Driver - Tax Filing Questions - Canada. Youll need to record the number of miles you do keeping a detailed log of where you have travelled and then claim the set amount by HMRC. Make more time for whatever drives you.

Go to your phones My Files or Downloads folder and tap the Amazon Flex icon to install. Increase Your Earnings. Be your own boss.

Amazon Flex is a program where independent contractors called delivery partners deliver Amazon orders. As an independent contractor. With every offer youll see your expected earnings and how long your block is likely.

Also hurdlr connects you within the proper tax bracket of whichever state or province you working out of. Knowing your tax write offs can be a good way to keep that income in your. Go to Settings General Profiles or Device Management.

Once youve downloaded the app set up your account and passed a background check you can look for delivery opportunities that are convenient for you. Up to 20 cash back I did 1 shift with amazon flex as a independent contractor and i made 7650. Driving for Amazon flex can be a good way to earn supplemental income.

Posted by 5 minutes ago. New Amazon Flex Driver - Tax Filing Questions - Canada. Knowing your tax write offs can be a good way to keep that income in your pocket.

If you have a W-2 job and do Amazon Flex for extra money you can increase your withholding at your main job instead of paying quarterly taxes. It automatically tracks milage and allows you to separate amazon flex miles business from personal in my case kilometers cause Im in Canada. If you use an iPhone set up trust for the app.

Make INR 120-140hour delivering packages with Amazon Flex. The rates are currently 45p for the first 10000 miles of driving. Under Canada tax jurisdictions settings add your Canada tax registrations numbers to activate each of them.

Open the Amazon Flex app to search for available delivery blocks in your area. Claiming for a Car on Amazon Flex Taxes. Do i need to claim that.

I would suggest downloading a tax application called hurdlr I use it for mileage and its awesome. Our Amazon Tax Exemption Program ATEP supports tax-exempt purchases for sales sold by Amazon its affiliates and participating independent third-party sellers. Unfortunately youll still have to report your income to the IRS even without a 1099.

Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone. Activate your Federal Goods and ServicesHarmonized Sales Tax GSTHST Enter your GSTHST registration number. A tax of 9975 is imposed on sales in Quebec.

The Amazon Tax Exemption Wizard takes you through a self-guided process of enrolment. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. If you are using your own car for Amazon then you can choose to claim an amount for the number of miles you drive.

A free inside look at company reviews and salaries posted anonymously by employees. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits. Fill out your Schedule C.

Review the Amazon tax calculation methodology accept then click Continue. From Settings select Tax settings. Be your own boss.

Canada Fulfilment by Amazon FBA service fees are subject to Canadian sales tax at the tax rate of the fulfilment centre providing fulfilment services regardless of your business location. Posted by 5 years ago. Selling on Amazon SoA and advertising fees are typically subject to taxes where the seller is.

Or download the Amazon Flex app. Your 1099-NEC isnt the only tax form youll use to file. First reserve a block.

Disable or uninstall any app that changes the lighting on your phone based on the time of day. Gig Economy Masters Course. No matter what your goal is Amazon Flex helps you get there.

When prompted tap Trust. After October 1 2021 AWS Canada will issue tax compliant invoices for all. Actual earnings will depend on your location any tips you receive how long it takes you.

Knowing your tax write offs can be a good way to keep that income in your pocket. Amazon Flex does not take out taxes. AWS Canada is registered for Canadian Goods and Services Tax GSTHarmonized Sales Tax HST Quebec Sales Tax QST British Columbia Provincial Sales Tax BC PST Manitoba Retail Sales Tax MB RST and Saskatchewan Provincial Sales Tax SK PST.

If you dont have other tax withholding that covers your tax liability you will need to make quarterly tax payments. To make sure you do this right just look through your bank statements and add up your direct deposits from Amazon Flex. Make more time for whatever drives you.

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

What It S Like To Be An Amazon Flex Delivery Driver Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Do Taxes For Amazon Flex Youtube

How To File Amazon Flex 1099 Taxes The Easy Way

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazon Flex Surge Drivers See 275 Offers And 55 Hour During Peak Season Ridesharing Driver

Everything You Need To Know About Amazon Flex Gridwise

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazon Flex Support How To Easily Contact Amazon Customer Service

Everything You Need To Know About Amazon Flex Gridwise

Digitek Drl 12c Professional 12 Inch Led Ring Light With Tripod Stand For Mobile Phones Camera 3 Color Mo Led Ring Light Led Ring Ring Light For Camera